India Ratings & Research (Ind-Ra) has affirmed Reliance Industries (RIL) long-term issuer rating at 'AAA'. The outlook is stable. The agency has also affirmed RIL's non-convertible debentures (NCDs) at 'AAA'.

India Ratings & Research (Ind-Ra) has affirmed Reliance Industries (RIL) long-term issuer rating at 'AAA'. The outlook is stable. The agency has also affirmed RIL's non-convertible debentures (NCDs) at 'AAA'.

The affirmation reflects RIL's strong and diversified presence in the Indian oil & gas sector with vertically integrated and cost-efficient operations across the supply chain. The company's exploration and production segment has a stake in three operating oil blocks in India as well as in active shale gas assets in the US. It also has a stake in developing oil blocks, eight domestic and three international. RIL is the second largest refiner in India by capacity with high complexity and also is the market leader in Indian petrochemical industry.

During FY14, refining operations contributed 50% to the consolidated EBIT, followed by the petrochemical business and oil & gas exploration and production 31.5% and 10.5%, respectively (FY13: 53.7%, 30% and 15%). The decline in contribution from oil & gas was due to a fall in natural gas production at Krishna Godavari (KGD6) block (FY14: 14mmscmd; FY13: 26mmscmd; FY12: 43mmscmd) and a USD1.1/barrel decline in gross refining margins. Production declined in the PannaMukti oil block due to a shutdown because of maintenance work. The Tapti oil block also reported lower production due to lower-than-estimated reserves. Consequently, EBITDA margin fell to 8% in FY14 (FY12: 9.7%). The decline in margins was partially offset by rupee depreciation and better petrochemical margin.

During FY14, refining operations contributed 50% to the consolidated EBIT, followed by the petrochemical business and oil & gas exploration and production 31.5% and 10.5%, respectively (FY13: 53.7%, 30% and 15%). The decline in contribution from oil & gas was due to a fall in natural gas production at Krishna Godavari (KGD6) block (FY14: 14mmscmd; FY13: 26mmscmd; FY12: 43mmscmd) and a USD1.1/barrel decline in gross refining margins. Production declined in the PannaMukti oil block due to a shutdown because of maintenance work. The Tapti oil block also reported lower production due to lower-than-estimated reserves. Consequently, EBITDA margin fell to 8% in FY14 (FY12: 9.7%). The decline in margins was partially offset by rupee depreciation and better petrochemical margin.

The ratings factor in RIL's strong liquidity due to its ability to consistently earn robust positive cash flow from operations with average consolidated CFO margin of near 9.5% over FY11-FY14. This is supported by a strong working capital cycle (FY14: 8 days) and robust EBITDA (Rs 349.4 billion). Also, the company reported free cash and equivalent of Rs 893.5 billion and undrawn committed term facilities of USD 5 billion on 31 March 2014.

RIL is exposed to oil commodity price cycles, however its diverse and integrated businesses help it maintain stable operating profit. Also, volatility in gross refining margins and petrochemical division’s profitability is mitigated by the high complexity of its refineries and a significantly diversified petrochemical product profile. However, RIL remains exposed to significant regulatory risk and is involved in arbitration proceedings regarding lower-than-estimated production from the KG-D6 block. Any adverse decision might negatively impact the profitability. RIL is also venturing into new business segments such as telecom and media, which might impact the company’s profit margin over the next two to three years

The ratings also reflect RIL's strong credit metrics with net leverage of 1.8x in FY14 and interest income being continuously higher than interest expenses. The ratings are supported by the company’s strong access to capital markets and its robust refinancing & financial flexibility.

Ind-Ra expects RIL's net leverage to rise over the next two to three years in view of the company's capex over USD 30 billion over FY15-FY17 across all its business segments; however, it is likely to remain within comfortable limits. A substantial portion (about 45%) of the capex will be incurred for the refining and petrochemical segments and could improve gross refining margins significantly. Another over 30% of the capex will be incurred in the telecommunication segment, the operations of which are expected to start from 2015.

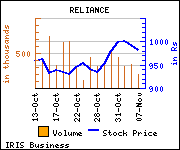

Shares of the company declined Rs 11.4, or 1.16%, to settle at Rs 969.50. The total volume of shares traded was 221,127 at the BSE (Monday).